The price of steel has soared in the last 7 months from around £500 per tonne to over £700 per tonne. The speed of the rise is unprecedented, with steel prices expected to increase throughout Q2 of 2021. Here we explore the reasons behind the sharp rise in material prices, the impact it has and how Laser 24 are supporting its customers through this challenging time.

The main reasons why steel prices have risen so sharply

Steel is one of the most important materials used in the construction industry. By far the biggest producer of crude steel is China, followed by the European Union, Japan, United States, India, Russia, and South Korea. A combination of factors including the rise in the cost of raw materials, EU quotas and limitations brought on by the Coronavirus pandemic are to blame for this crisis.

The rising price of the main raw material, iron ore

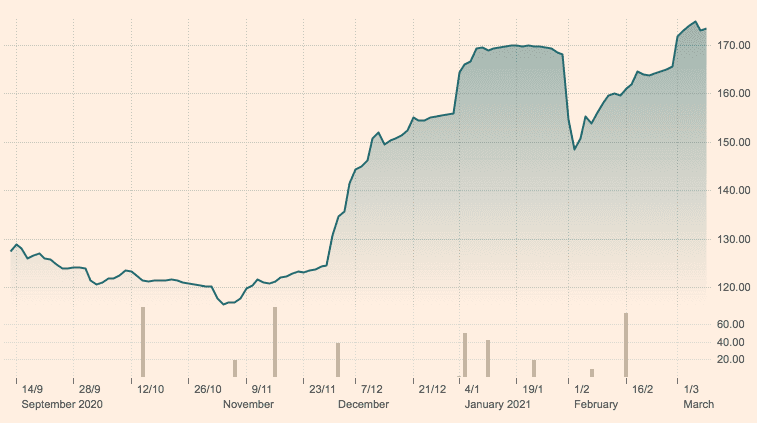

Steel is made from iron ore, a compound of iron, oxygen, and other minerals. In February, investment bank Credit Suisse forecast the price of iron ore reaching $150 (per tonne) in 2021. Today it has outstripped that forecast, sitting around $173 per tonne. That is the highest price we have seen in nearly a decade.

The reason for the iron ore price rise is increasing demand and reduced supply. China’s economic recovery following the outbreak of Coronavirus gained pace whilst the rest of the world was in lockdown. Strong Chinese demand and reduced supply created the perfect environment for a price increase, further fuelled by market momentum in the summer of 2021.

As the main component of the material, the rise in iron ore prices had a direct correlation to the sharp rise in the price of steel.

The rise in iron ore prices across 12 months. Source FT

The rise in price of scrap

In addition to the rise in iron ore, was the rise in the price of scrap materials. There has been a huge increase in prices over the past months and it too has had a significant impact on steel manufacturers.

Turkish scrap import prices climbed steeply towards $500 per tonne, in December 2020 and the first half of January, this year. Local concern over market volatility, however, caused values to tumble by around 20 percent, by early February. There is a real lack of clarity as to why the scrap price is rising so rapidly, what is clear is that scrap availability is really tight, resulting in the overall rise in material prices.

The continued threat of coronavirus

Demand for steel crashed during the pandemic because the construction industry all but stopped and this left steel producers with a backlog of materials. Although the markets did pick up, the threat of coronavirus still remains.

In January a spike in coronavirus cases in China’s top steel-producing region, Hebei, led many regions elsewhere in the country to decline entry to vehicles bearing Hebei licence plates, interrupting the flow of steelmaking raw materials. Likewise, the threat of a resurgence in Covid cases across Europe remains a concern for the industry. It’s both the economic fallout caused by coronavirus and the virus itself that still poses a threat to materials prices.

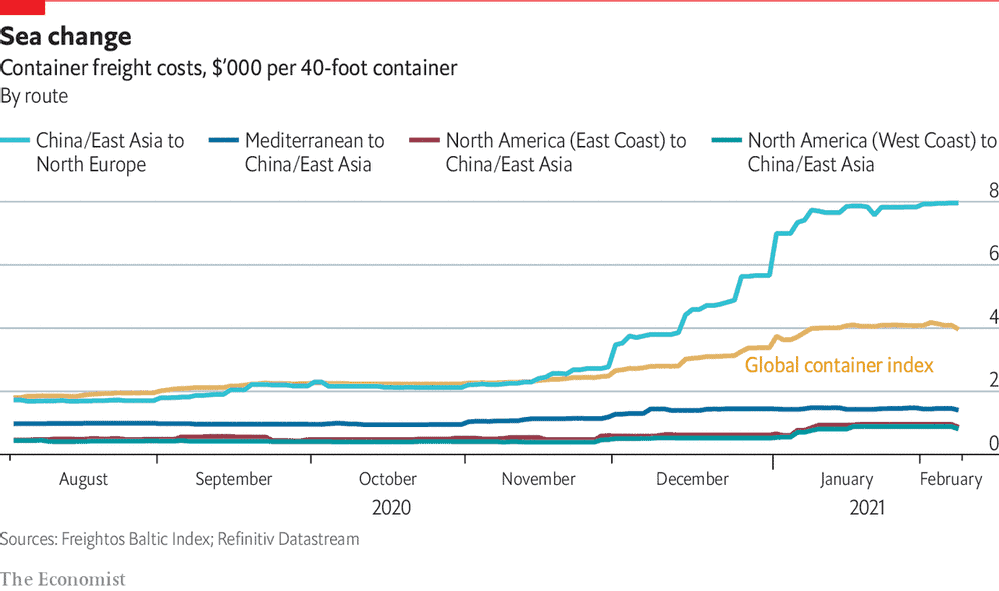

The shipping crisis and rise in freight costs

A global shipping crisis in December and January caused shipping costs to skyrocket as desperate companies waited weeks for containers and paid premium rates to receive them. Most significantly, the delay in shipping goods out of China and shortage of empty containers meant an increase in freight costs.

Container freight rates. Source: The Economist

The restrictions of EU safeguard quotas

Now there is the added customs clearance of EU material, which includes an administration cost, meaning import charges to rise and the cost of materials to skyrocket.

Will steel prices continue to rise?

As we have highlighted, the price of steel is very much controlled by the components that make it, the countries that export it, the means in which it is distributed and factors that cannot be controlled such as global pandemics. Will steel prices continue to rise? It appears in the short-term they could, but long-term it will depend on how quickly the iron ore supply chain stabilises and how long the aftershock of the coronavirus pandemic lasts.

How does Laser 24 help our customers receive a competitive price?

- By using our expert/inside knowledge

- Having great relationships with our material suppliers

- Buying a large tonnage, we gain a competitive rate from our suppliers

What Laser 24 are doing to help drive costs down?

In response to the recent health pandemic, an increased demand across all sectors has resulted in the rise of raw material prices, which are forecast to further increase until July 2021. At this stage, there are no visible changing in the market to suggest there is a price drop due anytime soon. Due to the volume of material we purchase coupled with continued efforts to build upon strong relationships with our current suppliers, Laser 24 are confident that we receive the most competitive prices, superior service levels and finest quality. We stock circa 65 tonnes of sheet and plate steel on our shop floor which places Laser 24 in a prime position to be your perfect production partner.

Laser 24 are one of the leading laser companies in the UK. See how we have helped a number of businesses reach their potential and complete award-winning projects at competitive prices. View our projects.

Get in touch today

Whether it’s an engineering, construction, marine, medical or architectural project, let us help you to create your laser cutting project within budget and to the highest standards by calling us on 01268 733883, emailing [email protected]