Back in March, we wrote about the soaring prices of steel and iron ore. The first quarter of 2021 saw steel prices rise in just a few months – a staggering rise at an even more staggering speed. But the increase didn’t slow down. In July 2021, the price of steel reached its peak as the country began to fully reopen.

In this article we are investigating the continuing uncertainty in steel prices. We’re looking at what to expect in the near future, and how Laser 24 can support its customers.

The initial cost increase was a result of the supply and demand complications caused by the Coronavirus pandemic. However, recent months have seen iron ore costs recede dramatically – but unfortunately, we’ve not seen the impact of this hit the price of steel. We forecast this to come into force in the next coming months.

Are steel prices still rising?

Steel is made from a compound of iron, oxygen and other minerals known as iron ore. In February 2021, Credit Suisse forecast the price of iron ore reaching $150 per tonne. It superseded even that between May and August 2021 due to increased demand.

As one of the world’s foremost steel manufacturers, China’s economic recovery played a large part of this. Their recovery was swift while the rest of the world remained in lockdown, and strong Chinese demand for steel saw the prices of iron ore increase dramatically. As the main component of steel, the knock-on effect on steel prices was inevitable.

Is the price of Iron Ore still on the rise?

As quickly as the price of iron ore rose, we’re now seeing a cost levelling – with predictions that it will continue to fall to its pre-pandemic level but as we know, this can change very quickly. There are no guarantees that prices will fall anytime soon.

Yet again, these fluctuations are a result of the world’s leading steel economy in China. As the buyer of around two thirds of global seaborne iron ore, China has now pledged to cut their steel output in the second half of 2021 in an attempt to combat the climate crisis. They hope to address pollution, energy use and the surge in power generation fuels such as thermal coal and natural gas.

Energy prices are currently skyrocketing around the globe – and turning crude materials into steel is an energy-dependant process. Electricity costs can represent up to 20% of the cost of converting ore to steel.

The Chinese conglomerate Jingye owned ‘British Steel’ recently told Today UK that power prices have soared in recent months.

Energy prices are soaring both at home and in industrial settings.Global wholesale prices for energy are rising due to a perfect storm of factors. A colder than average winter in Europe plus a hotter than average summer in Asia have seen stored gas levels decrease, and demand skyrocket.

What are Laser24 doing to support customers?

As a leading UK Laser cutter, Laser24 can help to drive costs down and ensure customers receive a competitive price.

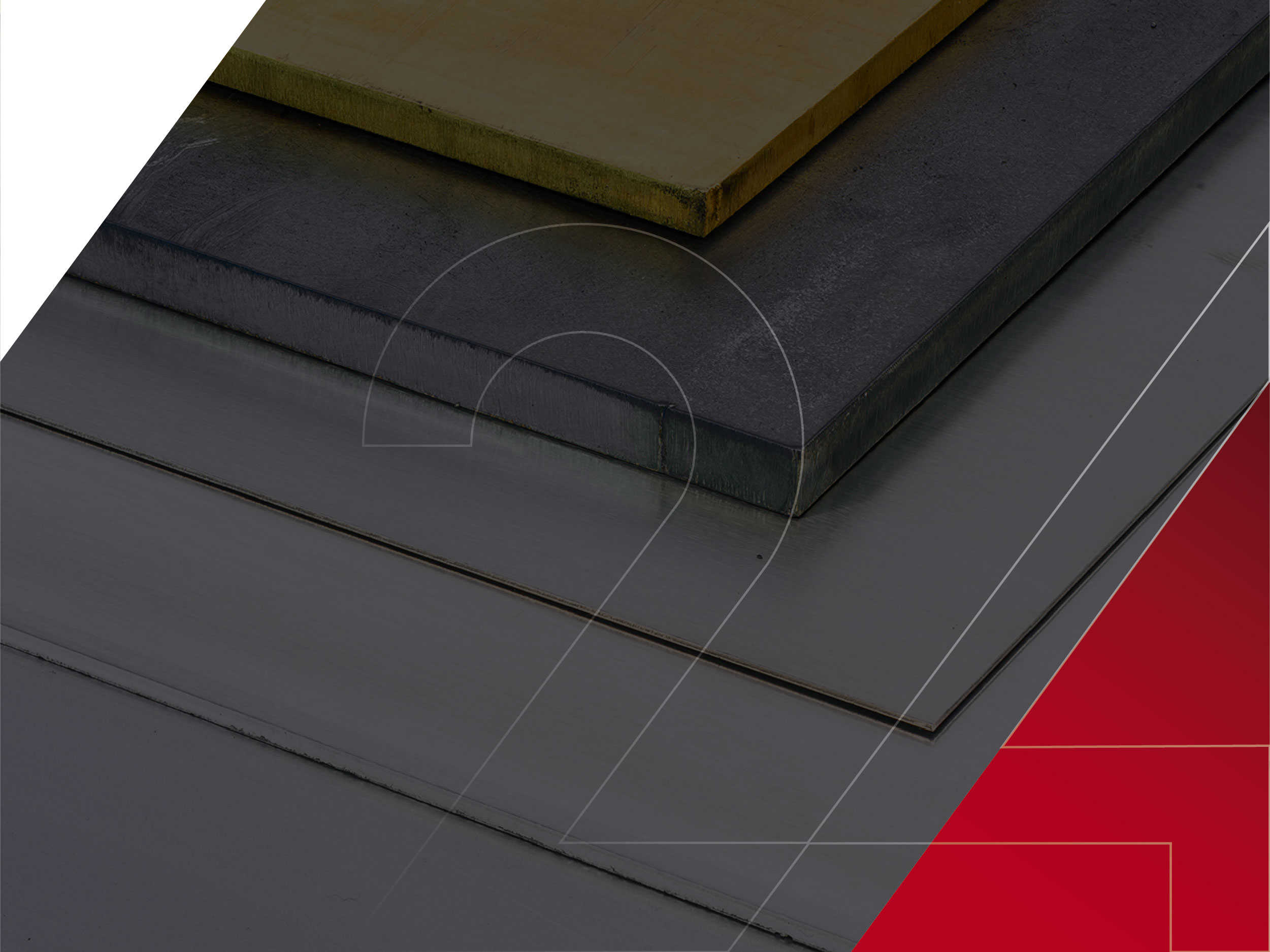

Due to the volume of material we purchase coupled with continued efforts to build upon strong relationships with our current suppliers, Laser 24 are confident that we receive the most competitive prices, superior service levels and finest quality. We stock circa 65 tonnes of sheet and plate steel on our shop floor which places Laser 24 in a prime position to be your perfect production partner.

Get in touch today

When it comes to laser We offer a range of services for a variety of materials, such as stainless steel laser cutting and aluminium laser cutting.

Take a look at our projects to see how one of the top laser companies in the UK can help you. Whether it’s an engineering, construction, marine, medical or architectural project, let us help you to create your laser cutting project within budget and to the highest standards by calling us on 01268 733883, emailing [email protected]